AI’s Shield: Revolutionizing Financial Fraud Detection & Cybersecurity

Introduction

In the sprawling digital landscape of modern finance, a silent war is being waged every second of every day. Financial institutions, from global banks to nimble fintech startups, are on the front lines, defending against an ever-evolving barrage of sophisticated financial attacks. The cost is staggering, with global fraud losses reaching hundreds of billions annually. Traditional, rule-based security systems, once the standard, now struggle to keep pace with the creativity and speed of digital criminals. They’re like guards trying to check a list of known faces while the intruders wear infinitely changeable masks.

Enter Artificial Intelligence (AI)—the game-changing shield in this high-stakes battle. AI is not just another tool; it represents a fundamental paradigm shift in how we approach financial security. By harnessing the power of machine learning, real-time analytics, and predictive modeling, AI is building a proactive, intelligent, and resilient defense system for the entire financial ecosystem.

This deep dive explores the revolution underway. We’ll unpack precisely how AI stops financial fraud, examine its critical role in bolstering financial cybersecurity AI, and look ahead to the future of financial security. Get ready to discover how AI is moving beyond simple detection to become the predictive, preventative core of modern financial resilience.

The Cracks in the Armor: Why Traditional Fraud Detection Is Failing

For decades, the financial industry relied on rule-based systems to flag suspicious activity. These systems work off a static set of “if-then” scenarios. For example: If a transaction is over $10,000 and occurs in a different country, flag it for review.

While logical, this approach has critical weaknesses in the face of modern threats:

- High False Positives: These rigid rules often flag legitimate transactions, leading to frustrated customers whose cards are declined and overwhelmed security teams chasing ghosts.

- Inability to Adapt: Scammers constantly change their tactics. A rule-based system is always one step behind, waiting for a new fraud pattern to be identified and a new rule to be written.

- Volume Overload: The sheer volume of daily transactions is too massive for human teams to monitor effectively without significant technological aid. Malicious activities can easily get lost in the noise.

- Lack of Context: These systems can’t understand the context or behavior behind a transaction. Is a large purchase unusual for this specific customer? Rule-based systems typically can’t answer that nuanced question.

This reactive posture is no longer sustainable. The need for a smarter, more dynamic defense has paved the way for AI-powered solutions.

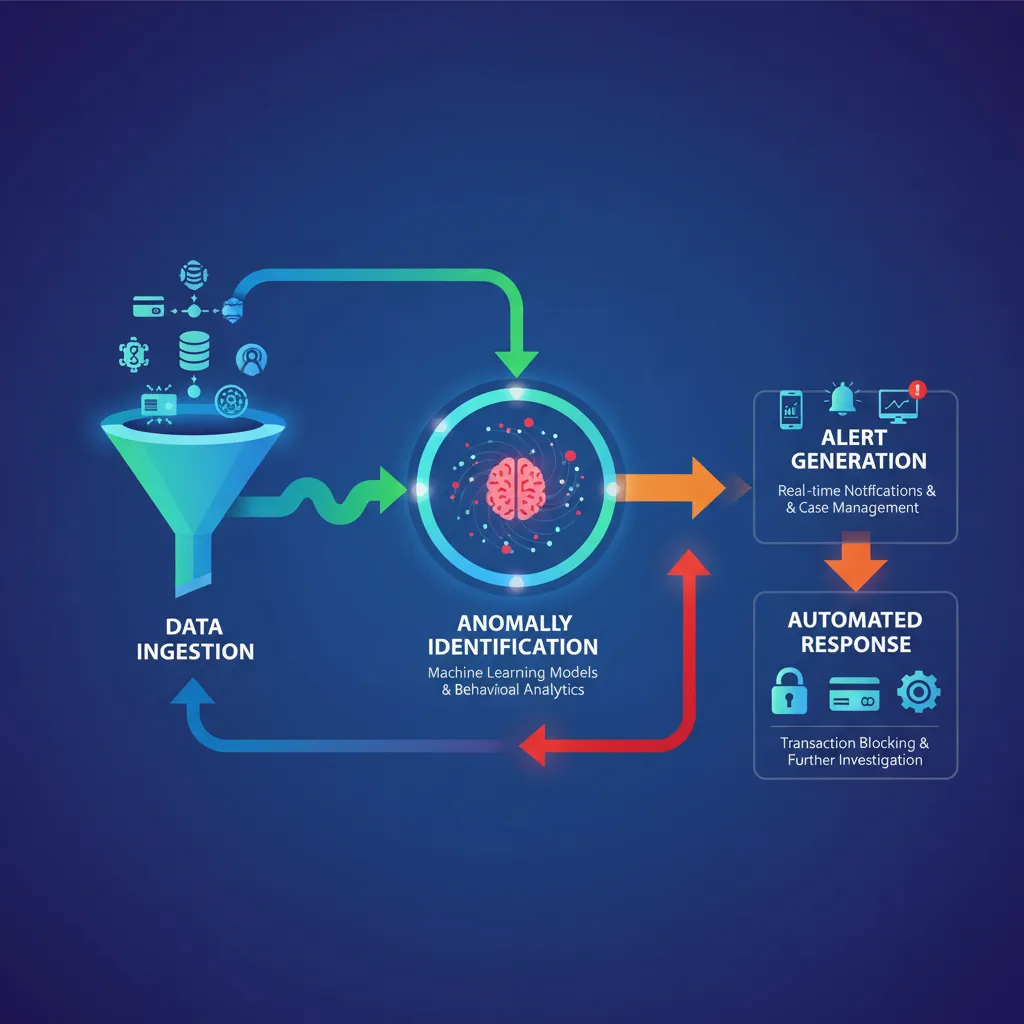

How AI Stops Financial Fraud: The Core Mechanisms

AI doesn’t just follow rules; it learns, adapts, and predicts. It acts like a digital detective with superhuman pattern-recognition abilities, working 24/7. The core of AI fraud detection lies in its ability to understand what’s normal so it can instantly spot what’s not.

Machine Learning & Predictive Fraud Models

At the heart of AI and financial crime prevention is machine learning (ML). Instead of being explicitly programmed, ML algorithms are trained on colossal datasets containing billions of historical transactions—both legitimate and fraudulent.

- Supervised Learning: Models are trained on labeled data. They learn the specific characteristics that define past fraudulent activities, enabling them to build highly accurate predictive fraud models. When a new transaction comes in, the model can predict the probability of it being fraudulent.

- Unsupervised Learning: This is where AI truly shines. The system is given unlabeled data and tasked with finding hidden patterns and anomalies on its own. This is crucial for detecting novel or emerging fraud tactics that have never been seen before.

This machine learning financial crime approach allows systems to evolve continuously, getting smarter and more accurate with every transaction they analyze.

Real-Time Fraud Analytics and Anomaly Detection

Speed is everything. Financial fraud happens in milliseconds, and the response must be just as fast. Real-time fraud analytics powered by AI can analyze dozens of variables for every single transaction as it occurs. This includes the transaction amount, location, time of day, device used, and merchant type.

The system establishes a unique behavioral baseline for each customer. When a transaction deviates significantly from this baseline, it’s flagged as an anomaly. For example, if a card that is typically used for small local purchases is suddenly used for a large electronics purchase thousands of miles away at 3 AM, the AI anomaly detection finance engine flags it instantly, often before the transaction is even completed. This immediate transaction monitoring AI is a cornerstone of modern fintech fraud prevention.

Behavioral Biometrics and Digital Identity Verification AI

Fraudsters can steal your password or your credit card number, but can they steal how you type? Behavioral biometrics fraud prevention adds a powerful layer of security by analyzing how a user interacts with their device.

AI models can create a profile based on:

- Typing cadence: The rhythm and speed of a user’s keystrokes.

- Mouse movements: How a user navigates a page or hovers over buttons.

- Device handling: The angle at which a user holds their phone.

If a login attempt uses the correct credentials but the behavioral patterns don’t match the legitimate user’s profile, the digital identity verification AI can block the attempt or trigger a request for further authentication. It’s a form of identity verification that goes beyond what you know (password) to who you are (behavior).

AI’s Multi-Faceted Role in Fortifying Financial Cybersecurity

AI’s impact extends far beyond just credit card fraud. It is becoming an indispensable part of a multi-layered financial cybersecurity AI strategy, creating a resilient defense network for the entire institution.

Beyond Fraud: AI in Anti-Money Laundering (AML) and KYC

Money laundering is a complex web of transactions designed to hide the origin of illicit funds. Manually tracing these webs is a monumental task, but AI excels at it. AI in anti-money laundering uses network analysis to uncover subtle, hidden relationships between accounts and transactions that might appear legitimate in isolation.

Similarly, AI powered KYC AML (Know Your Customer/Anti-Money Laundering) processes are being streamlined. AI can automate identity verification, cross-reference customer data against global watchlists, and continuously monitor accounts for suspicious changes, ensuring stronger regulatory compliance AI finance with less manual effort.

Related: AI in Finance: The Future of Money & Personal Wealth

The Generative AI Double-Edged Sword in Banking Security

The rise of large language models presents both a new threat and a powerful new defense.

- The Threat: Criminals are using Generative AI to create hyper-realistic phishing emails, voice scams (vishing), and deepfake videos that are incredibly difficult for humans to detect.

- The Defense: On the other side, Generative AI banking security teams use the same technology for good. They can generate synthetic data to train fraud models without compromising real customer data. They also use AI to simulate sophisticated phishing attacks to train employees and test the organization’s defenses, hardening the human firewall.

Related: Google’s Project Astra: The Future of AI as a Universal Agent

The Clear Benefits of AI in Banking Security

Integrating AI solutions for financial institutions isn’t just about better defense; it’s about building a more efficient, intelligent, and customer-centric operation.

- Drastically Reduced False Positives: By understanding context and individual behavior, AI significantly reduces the number of legitimate transactions that get flagged, improving the customer experience.

- Unmatched Speed and Accuracy: AI can analyze data and make decisions in milliseconds, stopping fraud before financial loss occurs.

- Enhanced Operational Efficiency: Automating routine monitoring and analysis frees up human fraud investigators to focus on complex, high-stakes cases that require human intuition.

- Proactive Threat Hunting: AI systems don’t wait for an attack. They actively hunt for network vulnerabilities and potential threats, bolstering cybersecurity for banks.

- Increased Financial Resilience: A strong AI defense system builds trust with customers and regulators, strengthening the institution’s reputation and its ability to withstand shocks in the financial landscape. AI’s impact on financial resilience is profound.

Navigating the Hurdles: Challenges and Ethical AI in Finance

The path to AI integration is not without its challenges. Implementing these powerful systems requires careful consideration of several critical factors.

Data Privacy and Security

AI models are only as good as the data they are trained on. This requires access to vast amounts of sensitive customer data, raising significant privacy concerns. Strong data governance, encryption, and compliance with regulations like GDPR are paramount. The challenge of data privacy financial AI is a central focus for developers and regulators alike.

The “Black Box” Problem and Ethical AI

Some complex AI models, particularly deep learning networks, can be “black boxes”—meaning even their creators don’t fully understand how they arrive at a specific decision. This lack of transparency can be problematic for regulators who require explainable decisions, especially when a transaction is denied. The field of Explainable AI (XAI) is working to solve this, but ensuring ethical AI finance security—free from hidden biases that could unfairly target certain demographics—is an ongoing effort.

The Human Element: Augmentation, Not Replacement

The most effective security posture is one that combines machine intelligence with human expertise. AI is brilliant at sifting through data and flagging high-probability threats, but the nuanced, complex investigations often require human intuition and critical thinking. The goal is a collaborative ecosystem where AI augments the capabilities of human analysts, allowing them to perform at a higher level.

The Future of Financial Security: A Glimpse of What’s Next

The evolution of financial security is accelerating. As technology advances, so too will the sophistication of our defenses. Here’s what’s on the horizon.

The Convergence of AI and Blockchain for Financial Security

Blockchain for financial security offers an immutable, decentralized ledger that is inherently resistant to tampering. When combined with AI’s analytical power, it creates a formidable defense. AI can monitor blockchain transactions for suspicious patterns indicative of money laundering or fraud, bringing intelligent oversight to the world of decentralized finance.

Related: Decentralized Science: How Blockchain and AI Are Building a New Research Revolution

Preparing for the Quantum Threat

While still in development, quantum computing financial fraud represents a long-term existential threat to current cybersecurity standards. Quantum computers will one day be powerful enough to break the encryption that protects virtually all financial data. Forward-thinking institutions are already using AI to develop “quantum-resistant” cryptographic algorithms to safeguard data for the coming quantum era.

The Rise of Next-Gen Financial Security AI

The next wave is already forming. We can expect to see wider adoption of:

- Federated Learning: Training AI models across multiple decentralized devices or servers without exchanging raw data, enhancing privacy.

- Explainable AI (XAI): Making AI decisions more transparent and understandable to humans and regulators.

- Hyper-Personalized Security: AI that adapts security protocols in real-time based on an individual user’s location, device, and typical behavior.

This is the era of next-gen financial security AI, a dynamic and ever-learning defense system tailored to both the institution and the individual.

Conclusion

The fight against financial crime has fundamentally changed. We’ve moved from building static walls to deploying an intelligent, adaptive immune system. Artificial Intelligence is the engine of this new paradigm, offering a powerful shield against threats that are growing more sophisticated by the day.

From real-time fraud analytics that stop theft in its tracks to complex models that dismantle money laundering rings, AI is proving to be the most crucial ally in the financial industry. The journey involves navigating challenges of data privacy and ethics, but the benefits—enhanced security, greater efficiency, and a more resilient financial world—are undeniable. As we look to the future, the continued innovation in AI will not just be an advantage; it will be essential for survival and trust in the digital economy.

The next time you tap your card or make an online payment, remember the silent, intelligent guardian working in the background, ensuring your transaction is safe. That is the power and promise of AI’s shield.

Frequently Asked Questions (FAQs)

Q1. How is AI used in fraud detection?

AI is used in fraud detection to analyze vast amounts of transaction data in real-time. It uses machine learning algorithms to learn the normal behavior of a customer and then identifies anomalies or deviations from that pattern, which could indicate fraud. This allows for the instant flagging of suspicious activities like unusual purchase amounts, locations, or frequencies.

Q2. What is an example of AI in banking?

A common example of AI in banking is AI in credit card fraud detection. When you make a purchase, an AI model instantly assesses dozens of variables (your location, the store, the amount, your purchase history) to assign a risk score. If the score is too high, the transaction may be declined, and you might receive a text message alert to verify the purchase.

Q3. How does machine learning detect financial crime?

Machine learning detects financial crime by training on historical data containing both legal and fraudulent transactions. It learns to recognize the subtle patterns and characteristics associated with criminal activity. When it analyzes new data, it uses these learned patterns to predict the likelihood of fraud or to cluster suspicious activities together, revealing complex crime rings that would be invisible to human analysts.

Q4. What are the limitations of AI in fraud detection?

The main limitations include a heavy reliance on large, high-quality datasets; the potential for biases in the data to lead to unfair outcomes; and the “black box” problem, where it can be difficult to understand why the AI made a certain decision. Additionally, AI systems require constant monitoring and retraining to keep up with brand-new, unseen fraud tactics.

Q5. What is the role of AI in KYC and AML compliance?

In KYC (Know Your Customer) and AML (Anti-Money Laundering), AI automates and enhances the process of verifying customer identities and monitoring transactions. It can rapidly scan documents, perform background checks against global watchlists, and analyze transaction networks to uncover sophisticated money laundering schemes, helping financial institutions meet strict regulatory compliance AI finance requirements more efficiently.

Q6. Can AI predict fraud before it happens?

Yes, one of the key benefits of AI in banking security is its predictive capability. By analyzing subtle precursors and patterns in data, predictive fraud models can identify accounts or activities that have a high probability of becoming fraudulent in the future. This allows banks to take preemptive action, such as adding extra security checks to a high-risk account.